-

Implications of Company Franking Credits

Posted by Team AVS on 16 Oct, 2017 0 CommentsThe recent cut to the tax rate for incorporated businesses that turnover less than $50 million a year, while generally welcomed, can bring with it some important considerations when it comes to distributing franked dividends.

The rate change to 27.5% is to be staggered, starting with companies that turnover up to $10 million a year, with retrospective effect from July 1, 2016. It will then apply to companies turning over up to $25 million in 2017-18, and then to $50 million turnover companies for 2018-19.

Note: These tax cuts only apply to companies that actively “carry on a business”.

From 2016-17, the imputation system will be based on a company’s corporate tax rate for a particular income year, worked out having regard to the company’s aggregated turnover for the previous year.

This is because a company will not know its aggregated turnover for the year in which it pays a dividend (and therefore its corporate ta rate for the year) until after the end of that year.

How this works

In the 2015-16 income year, Company ABC has an aggregated turnover of $9 million. In the 2016-17 income year, its aggregated turnover increased to $11 million.

Therefore, for the 2016-17 income year, Company ABC will have:

- A corporate tax rate of 30% (having regard to its aggregated turnover of $11 million in the 2016-17 income year)

- A corporate tax rate for imputation purposes of 27.5% (based on an aggregated turnover of $9 million in the 2015-16 income year), and

- A corporate tax gross-up rate of 2.64 — that is, (100% – 27.5%)/27.5%.

As a result, if Company ABC makes a distribution of $100 in the 2016-17 income year, the maximum franking credit that can be attached to the distribution is $37.88 — that is, $100/2.64.

Possible broader impact on shareholders

Companies will benefit from the rate cuts provided that the funds are retained. However, the tax burden will be shifted to the shareholder upon the distribution of a franked dividend.

Australian resident shareholders will pay more top-up tax on dividends received from companies eligible for the tax cuts as the company tax rate decreases.

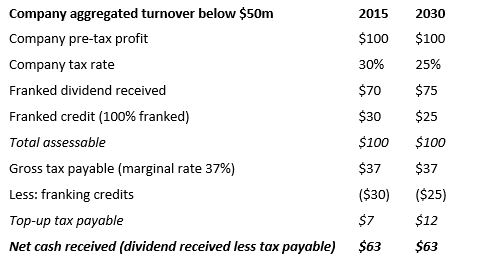

Ultimately, the total tax liability on the company’s pre-tax profits will still be at the shareholder’s marginal rate, but a greater proportion of the burden will sift from the company to the shareholder over time. As the table below shows, the net cash received in relation to the dividend will remain the same.

If you have any questions, feel free to ask them in the comments section. We will be happy to answer all your queries

AVS BusinessServices @ What the

AVS BusinessServices @ What the

Comments